We also place great emphasis on gaining a comprehensive understanding sustainability and its impact at the grass-root level. These practices are coupled with active asset management to create long term value for the respective stakeholders.

HDFC Capital Advisors Limited is an investment manager to:

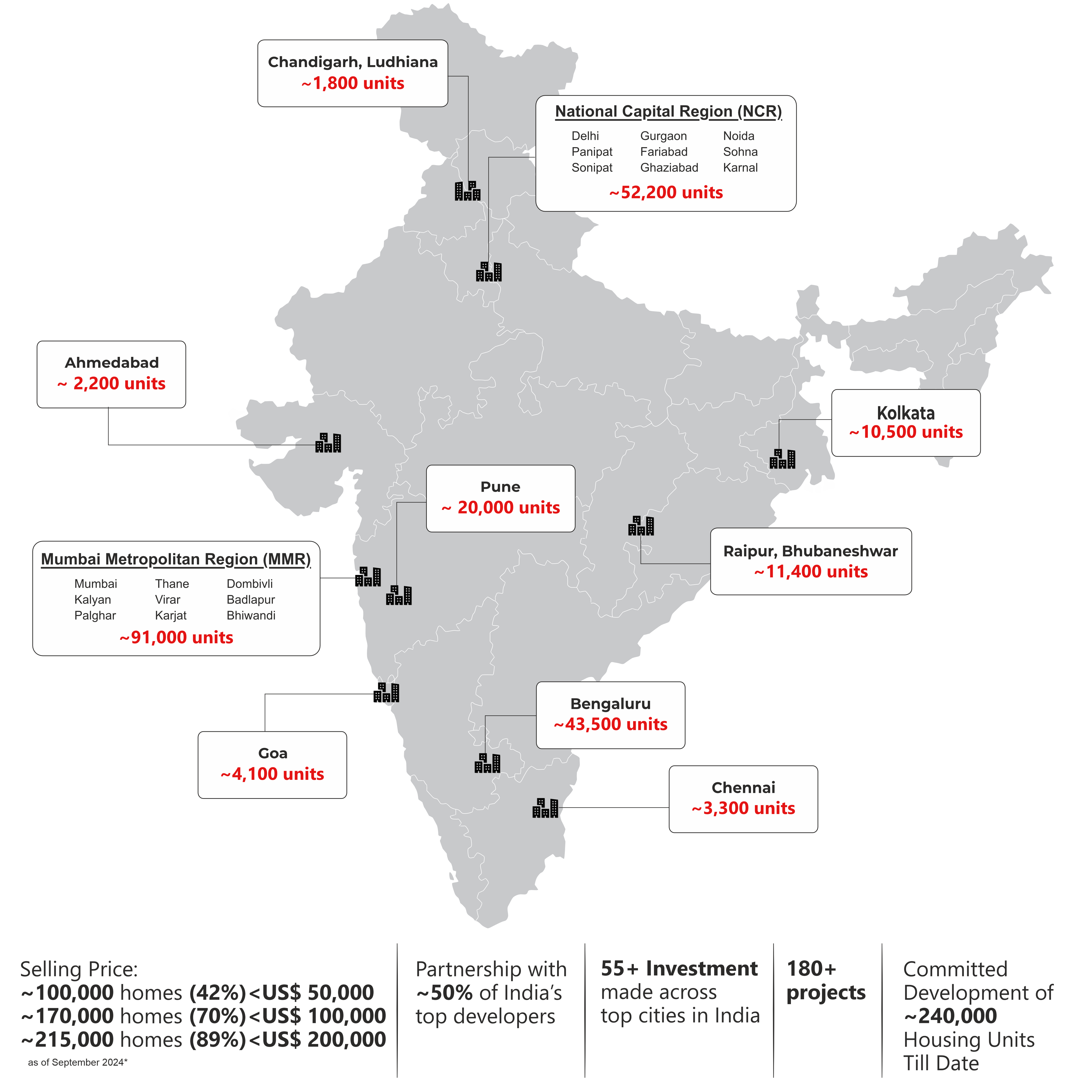

each, being a Category II Alternative Investment Fund registered with the Securities and Exchange Board of India. They combine as a ~USD 4.5 billion platform dedicated to financing the supply of affordable and mid-income housing across India.

Affordable housing is a critical component of quality urban infrastructure as well as a growth driver for the real estate industry in India. The HCARE series of funds partner with developers to focus on long term financing solutions, across the capital stack of debt and equity, for affordable and mid-income housing.

Our investments are focused towards our stated objective of addressing the demand-supply gap of affordable housing in India. We finance homes in city suburban regions with proximity to social infrastructure for the low & mid income and economically weak customer segments.

We want to be a catalyst for growth for the entire affordable housing eco-system, through financing as well as driving efficiencies of cost and time through active asset management of our projects.